Introduction

The allure of owning a waterfront home on Lake Kanasatka is truly captivating. It promises a serene escape and a lifestyle that many dream of. But let’s be honest: the journey to purchasing such a property can feel overwhelming. It’s filled with complexities that require thoughtful planning and informed decision-making.

Have you ever wondered what it takes to make this dream a reality? This article outlines five essential steps that every prospective buyer should consider:

- Evaluating your financial readiness

- Navigating local regulations

- Conducting thorough inspections

- Understanding the market trends

- Working with a knowledgeable real estate agent

With so much at stake and a competitive market, how can you ensure you’re fully prepared to make one of the most significant investments of your life? Let’s explore these steps together, so you can approach this exciting journey with confidence.

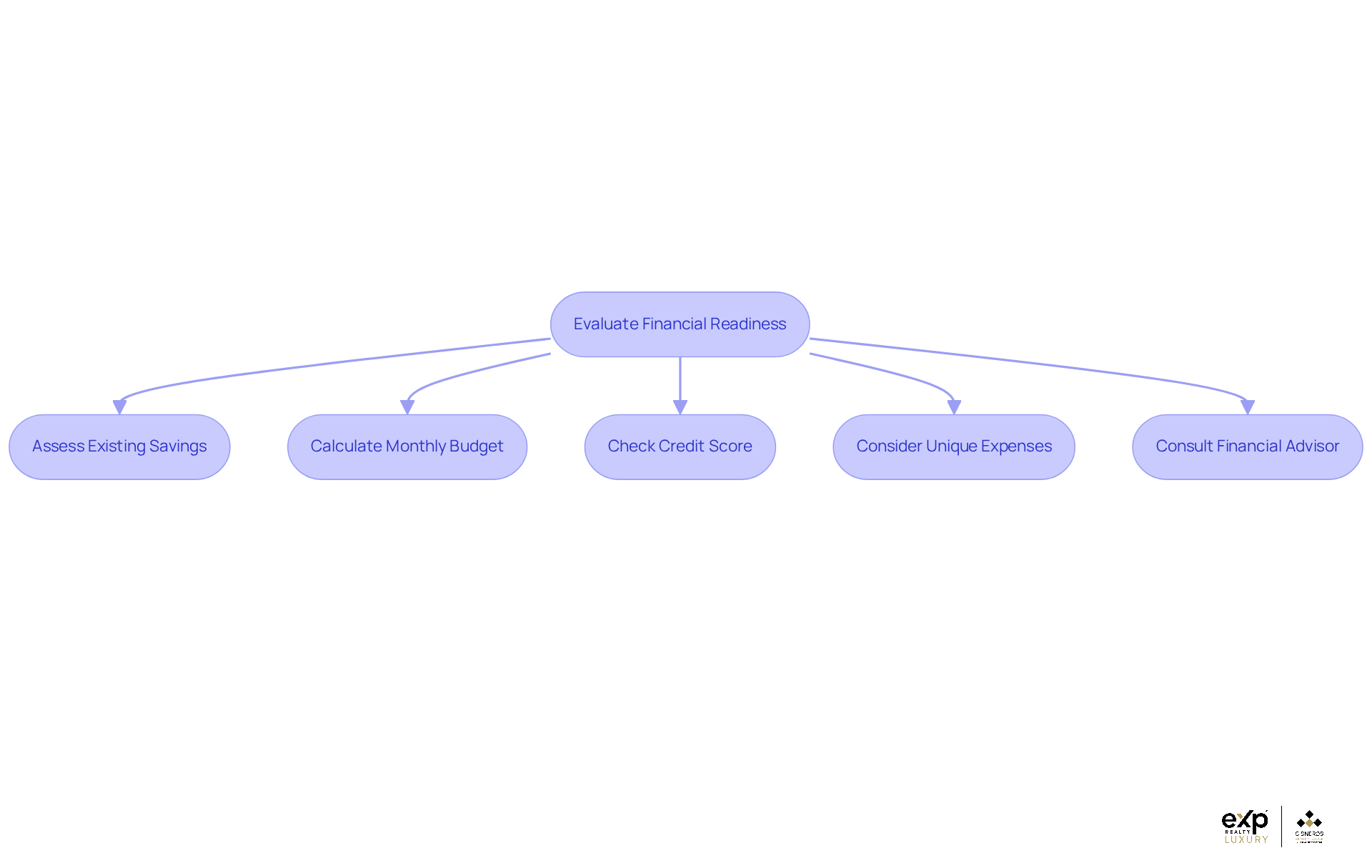

Evaluate Your Financial Readiness and Budget

Are you dreaming of waterfront homes for sale in Lake Kanasatka NH fixer upper for a serene lakeside property? It’s a beautiful aspiration, but before you dive in, it’s essential to evaluate your existing savings. This will help you identify a suitable down payment for your future waterfront homes for sale in Lake Kanasatka NH fixer upper.

Next, take a moment to calculate your monthly budget. Remember to factor in:

- Mortgage payments

- Land taxes

- Insurance

- Upkeep expenses

Lakeside homes often come with higher maintenance costs, sometimes adding thousands of dollars to your annual expenses. It’s crucial to be prepared for these additional financial responsibilities.

Have you checked your credit score and financial history lately? Understanding your borrowing capacity is vital, as it will influence your financing options. A solid credit score can open doors to better mortgage rates, making your dream home more attainable.

Don’t forget to consider extra expenses unique to lakeside living. Flood insurance can be both intricate and costly, and if your property has docks or seawalls, they may require special care. When considering waterfront homes for sale in Lake Kanasatka NH fixer upper, it's important to note that they typically command prices 30-50% higher than comparable non-waterfront properties, so budgeting accordingly is essential.

Finally, consulting with a financial advisor or mortgage broker who understands the nuances of property financing can be incredibly beneficial. Their expertise can guide you through the distinctive financial landscape of lakeside homeownership, ensuring you’re ready for both the rewards and responsibilities that come with it. Taking these steps will help you feel more confident and prepared as you embark on this exciting journey.

Research Waterfront Property Regulations and Maintenance Needs

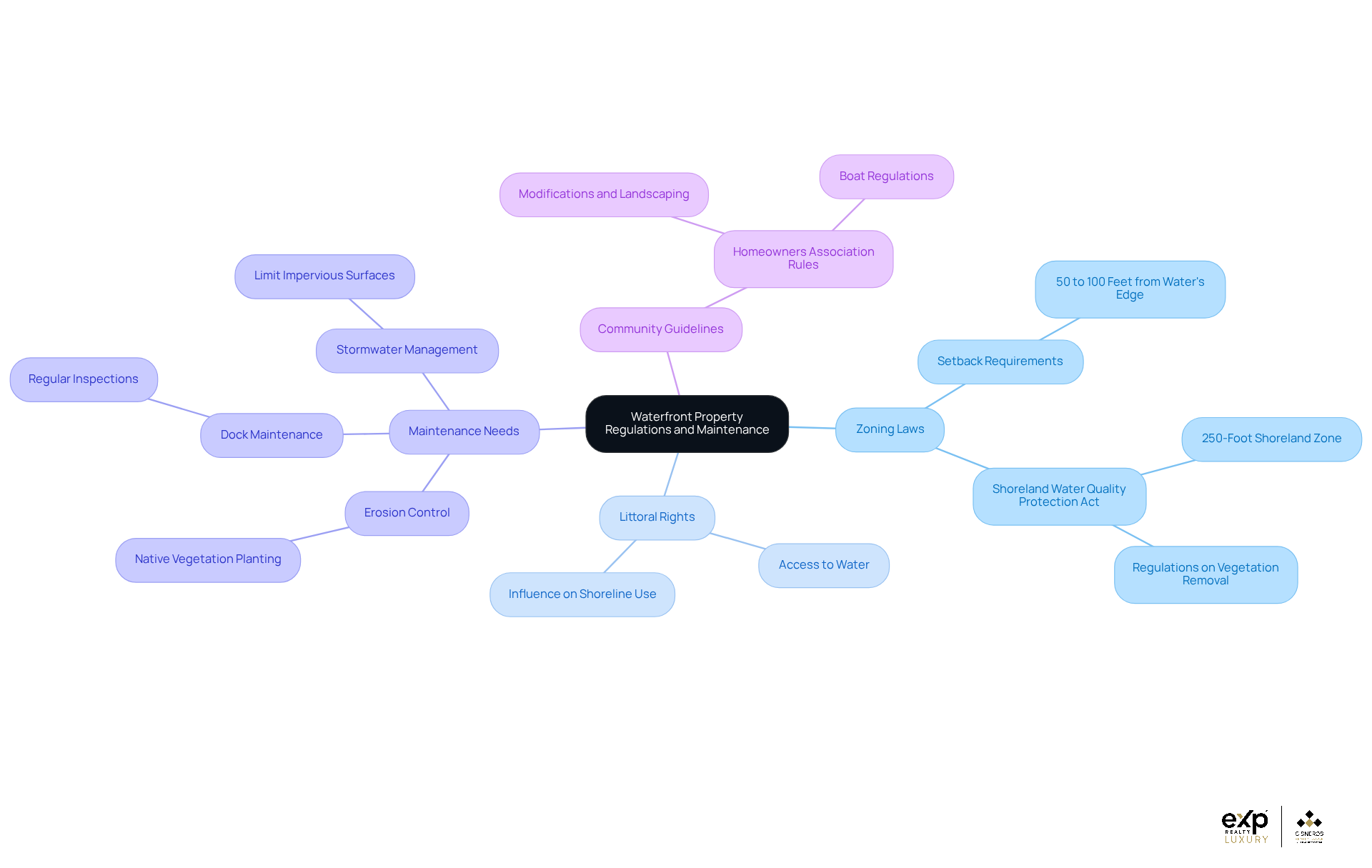

When considering a lakeside property, it’s essential to examine local zoning laws and regulations, particularly those related to Lake Kanasatka. These laws often come with building restrictions, such as setback requirements that typically mandate a distance of 50 to 100 feet from the water's edge. This is designed to minimize erosion and protect water quality. One key regulation to be aware of is the Shoreland Water Quality Protection Act (SWQPA), which governs activities within a 250-foot shoreland zone to ensure clean water and healthy ecosystems.

Have you thought about your littoral rights? These rights grant landowners access to the water and can significantly influence how you utilize your shoreline estate. As Mark Shattuck wisely notes, "Due to the more stringent construction codes, zoning regulations, and coastal environmental guidelines related to this type of land, it’s essential to collaborate with builders and architects who are highly experienced in developing such areas." Consulting with real estate experts can help ensure compliance and maximize your asset’s potential.

Living by the water comes with unique maintenance requirements. Homes in these areas often need more frequent care due to environmental exposure. This includes erosion control measures, like planting native vegetation to stabilize soils, regular dock maintenance, and ensuring that any structures comply with local regulations to avoid costly violations. For example, implementing stormwater management strategies can help limit impervious surfaces and reduce runoff.

It’s also important to review community guidelines or homeowner association (HOA) regulations that may apply to lakeside locations. HOAs often enforce strict rules regarding modifications, landscaping, and even the types of boats allowed on the premises, which can impact your enjoyment and use of your home.

If you have any uncertainties about regulations, don’t hesitate to consult with local authorities or experienced real estate professionals. Engaging with knowledgeable specialists can help you navigate the complexities of coastal real estate ownership, ensuring you’re well-informed about all legal and environmental factors. Remember, you’re not alone in this journey; there are resources and people ready to support you.

Consult with Local Real Estate Experts Specializing in Waterfront Homes

Are you dreaming of waterfront homes for sale in Lake Kanasatka NH fixer upper by the water? It’s a beautiful aspiration, and finding the right real estate agent can make all the difference in turning that dream into reality. Start by reaching out to agents who have a solid track record in selling waterfront properties in your desired area. Look for those who have successfully closed deals on similar homes, as this indicates their familiarity with the unique aspects of waterway transactions.

Inquire about their specific experiences with waterfront properties and their insights into local market dynamics. Understanding the nuances of coastal real estate - like zoning laws and environmental considerations - is crucial for a successful purchase. Schedule consultations to discuss your needs and preferences; this will help you gauge their responsiveness, expertise, and ability to align with your vision for a lakeside home.

Don’t hesitate to ask for references from past clients. Hearing about others’ experiences can provide valuable insight into the agent’s dedication and the quality of service they offer. Positive testimonials can reassure you of their commitment to client satisfaction.

Consider attending local real estate seminars or workshops that focus on waterfront homes for sale in Lake Kanasatka NH fixer upper. These events can be a treasure trove of information, helping you connect with knowledgeable professionals who specialize in coastal real estate. Remember, you’re not just buying a property; you’re investing in a lifestyle. Take that next step with confidence!

Conduct Comprehensive Inspections of the Property

When considering waterfront homes for sale in Lake Kanasatka, NH fixer upper, it’s crucial to hire a qualified inspector who specializes in these unique properties. This step not only ensures a thorough assessment of the house's overall condition but also provides peace of mind. In New Hampshire, the average cost for a property inspection typically ranges from $700 to $1,200, a significant investment for any prospective buyer.

Think about the essential aspects that can impact your future home, such as:

- Foundation

- Roof

- Any signs of water damage or mold

These factors can greatly affect both the value and safety of your new asset. As Wilson Leung wisely points out, "A thorough home inspection provides peace of mind by ensuring you’re fully informed about the state of the residence."

Don’t forget to evaluate outdoor features like:

- Docks

- Seawalls

- Landscaping

Ensuring these elements are well-kept and structurally sound is vital for enjoying life in waterfront homes for sale in Lake Kanasatka, NH fixer upper. You might also want to consider additional inspections tailored to coastal concerns, such as marine surveys for docks and flood risk assessments. These can provide deeper insights into potential issues specific to shoreline locations.

Once you receive the inspection reports, take the time to carefully review them. Discuss the findings with your real estate agent to fully grasp their implications for your purchase. This collaborative approach will help you make an informed decision, ensuring that you feel confident and secure in your choice.

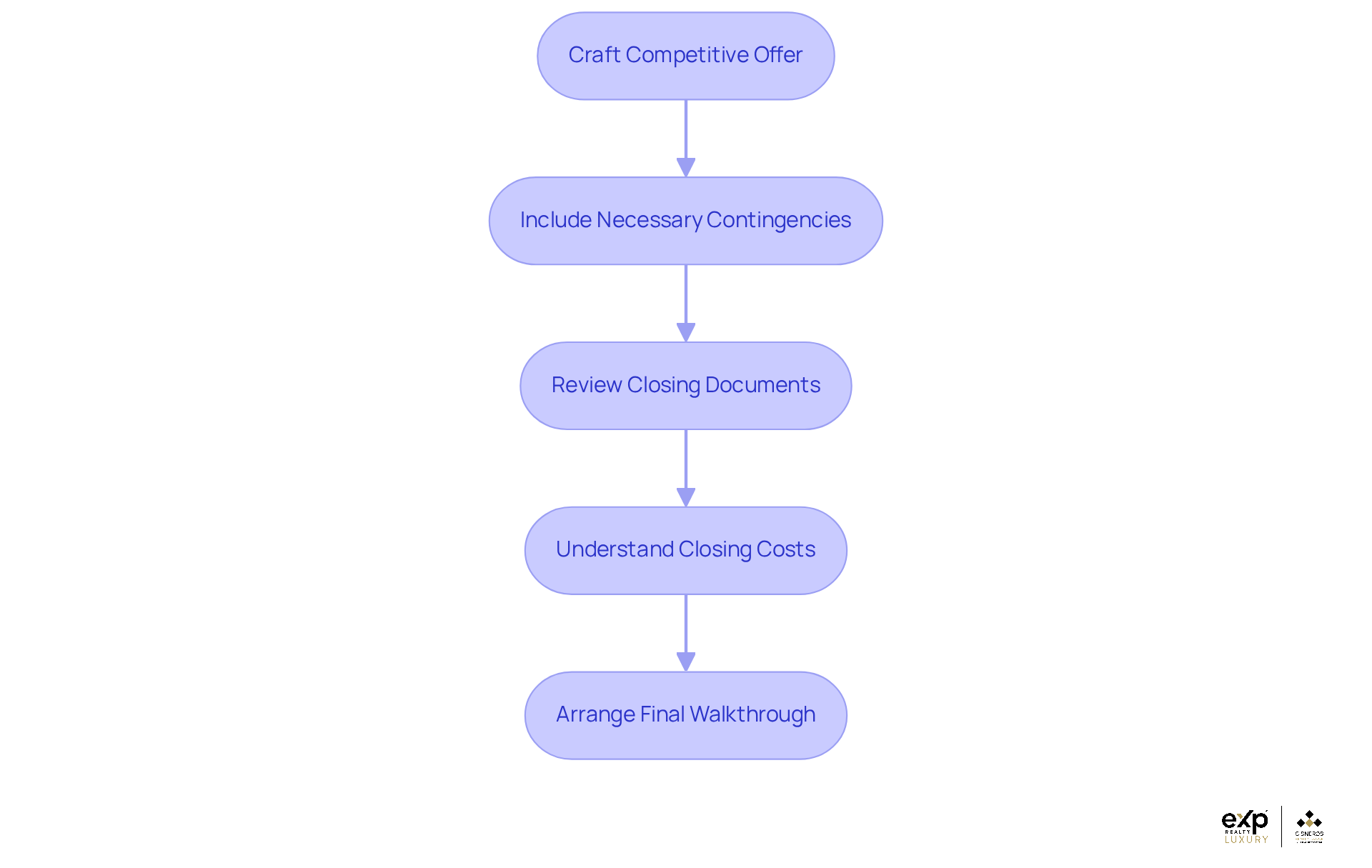

Finalize Your Offer and Understand Closing Procedures

When you're ready to make a move in the real estate market, collaborating with your agent to craft a competitive offer is key. Have you considered how recent market trends and the specific condition of the property can influence your proposal? With the strong interest in waterfront homes for sale in Lake Kanasatka NH fixer upper and other waterfront properties in New Hampshire, particularly in places like Moultonborough where prices often start above $1 million, having a knowledgeable offer is essential.

It's important to include necessary contingencies in your offer, such as property inspection results or financing approvals. This not only protects your interests but also helps ensure a smooth transaction. Have you thought about how these safeguards can give you peace of mind?

As you approach closing, take the time to carefully review all documents, including the Closing Disclosure and Deed. Understanding the terms and conditions of your purchase is crucial. Did you know that closing costs for waterfront homes for sale in Lake Kanasatka NH fixer upper can be significant, averaging around 2.3% of the sale price? For a median-priced home, that could mean around $11,564 in expenses.

Be prepared for various closing costs associated with waterfront homes for sale in Lake Kanasatka NH fixer upper, which might include:

- Title insurance

- Attorney fees

- Other specific charges

Knowing these costs upfront can help you budget effectively and avoid surprises. How would it feel to have a clear financial picture as you move forward?

Before finalizing your purchase, arrange a final walkthrough of the property. This is your chance to verify its condition and ensure that all agreed-upon repairs have been completed. Wouldn't it be reassuring to know that everything is in order before you take that big step?

Conclusion

Purchasing a waterfront home in Lake Kanasatka is more than just a transaction; it’s a journey filled with dreams and possibilities. Have you ever imagined waking up to the gentle sounds of nature, with the serene lake just outside your window? This venture requires thoughtful preparation, and by following the essential steps outlined here, you can navigate the complexities of lakeside property ownership with confidence.

Start by evaluating your budget and understanding your financial readiness. It’s crucial to recognize the unique maintenance needs of waterfront properties, which can differ significantly from traditional homes. Collaborating with knowledgeable local agents can make a world of difference, ensuring you’re well-informed about local regulations and market dynamics. Each step you take not only safeguards your investment but also enhances your experience as a waterfront homeowner.

Engaging with experts and understanding the nuances of the market can truly empower you. Remember, this journey is about embracing a lifestyle enriched by nature and tranquility. Take these steps seriously, and know that thorough preparation is the key to unlocking the beauty and joy of lakeside living. Whether it’s assessing your financial readiness or familiarizing yourself with zoning laws, being informed will help you make decisions that align with your vision and aspirations.

So, are you ready to take the next step toward your dream of lakeside living? Embrace this opportunity with open arms, and let the journey begin!

Frequently Asked Questions

What should I evaluate before purchasing a waterfront home in Lake Kanasatka, NH?

Before purchasing, evaluate your existing savings to determine a suitable down payment, and calculate your monthly budget, including mortgage payments, land taxes, insurance, and upkeep expenses.

Why is it important to check my credit score when considering a waterfront home?

Checking your credit score is vital as it influences your borrowing capacity and financing options. A solid credit score can help you secure better mortgage rates.

What additional expenses should I consider when buying a lakeside property?

Additional expenses include flood insurance, maintenance for docks or seawalls, and higher annual upkeep costs due to the unique nature of lakeside living.

How do waterfront properties typically compare in price to non-waterfront properties?

Waterfront homes for sale in Lake Kanasatka, NH, typically command prices that are 30-50% higher than comparable non-waterfront properties.

What regulations should I be aware of when buying a lakeside property?

You should examine local zoning laws and regulations, including building restrictions like setback requirements and the Shoreland Water Quality Protection Act (SWQPA), which governs activities within a 250-foot shoreland zone.

What are littoral rights and why are they important?

Littoral rights grant landowners access to the water and can significantly influence how you utilize your shoreline property.

What unique maintenance needs do lakeside homes have?

Lakeside homes often require more frequent care due to environmental exposure, including erosion control measures, regular dock maintenance, and compliance with local regulations.

Are there community guidelines or HOA regulations I should consider?

Yes, community guidelines or homeowner association (HOA) regulations may apply, enforcing strict rules on modifications, landscaping, and types of boats allowed, which can impact your enjoyment of the property.

How can I ensure compliance with local regulations when purchasing a waterfront home?

Consulting with builders, architects, and real estate experts who are experienced in coastal areas can help ensure compliance with regulations and maximize your property's potential.

What should I do if I have uncertainties about regulations related to lakeside properties?

If you have uncertainties, consult with local authorities or experienced real estate professionals who can help you navigate the complexities of coastal real estate ownership.