Introduction

Purchasing a waterfront home in Tuftonboro, NH, can feel like a thrilling adventure, but it can also be overwhelming. The promise of peaceful lake views and endless recreational activities is enticing, yet potential buyers often encounter a unique set of challenges. How do you navigate this journey while keeping your dreams of lakeside living alive?

This article will guide you through five essential steps to simplify the process. From setting a realistic budget to understanding local market trends and assessing property conditions, we’ll cover what you need to know. With property prices on the rise and mortgage rates fluctuating, it’s crucial to make informed decisions that align with your aspirations. Let’s explore how you can confidently embark on this exciting journey.

Establish Your Budget for Waterfront Homes

Creating a budget for waterfront homes for sale in Tuftonboro, NH, with a finished basement is a vital first step in your journey toward homeownership. Have you thought about what your total budget should include? It’s not just about the down payment; you’ll also need to factor in closing costs, which typically range from 2% to 5% of the purchase price. In 2025, the average cost for lakefront properties in Tuftonboro is around $799,000, with an expected rise of 3.7% in property prices. This makes it all the more important to strategize wisely.

As you budget, don’t forget about the additional costs that come with owning a property by the water. Property taxes, insurance, and maintenance can add up quickly. Currently, property tax rates in Tuftonboro hover around 1.5%, which can significantly impact your overall budget. Plus, properties near the water may require specialized insurance due to their unique location, further influencing your financial planning.

It’s also essential to explore potential financing options. With mortgage rates projected to average 6.3% in 2025, consider looking into various loan products to find what best suits your financial situation. Given the potential fluctuations in mortgage rates, locking in a rate early can be a smart move. Remember, monthly mortgage payments can vary greatly depending on the property's price and your down payment. Using a mortgage calculator can help you estimate your monthly expenses across different price levels.

Families often establish budgets by taking a close look at their financial health, including income, savings, and existing debts. Consulting with financial advisors can provide valuable insights; many emphasize the importance of not stretching your budget too thin, especially when considering the emotional and financial responsibilities of owning a lakeside property. As Maya Angelou beautifully said, a home is a sanctuary where you can truly be yourself. By following these steps, you can create a practical budget that aligns with your dream of owning a lakeside residence in Tuftonboro.

Identify Key Features of Waterfront Properties

When searching for a lakeside home in Tuftonboro, NH, it’s essential to prioritize features that truly enhance your experience. Think about dock access, stunning water views, and sandy beaches - these elements can significantly elevate both your enjoyment and the value of your home. With Cisneros Realty Group by your side, you’ll receive personalized real estate guidance tailored to your unique needs, helping you find the perfect fit for your family.

Consider the additional amenities that can make your living experience even better. Outdoor spaces for entertaining, cozy fire pits for evening gatherings, and easy access to recreational activities like boating and fishing are all plentiful in the Lakes Region. These features can transform your home into a cherished retreat.

It’s also important to evaluate the orientation of your potential home. Maximizing sunlight exposure and enhancing your views can greatly impact your overall satisfaction. Understanding the local landscape is crucial in making the right choice for your family.

Don’t forget to research local regulations regarding water rights, dock permits, and shoreline modifications. This knowledge is vital to ensure compliance and avoid any potential legal issues. Cisneros Realty Group is here to help you navigate these complexities with ease.

If you’re considering rental income from coastal properties, you’re not alone. Many buyers see this as a significant factor in their investment. The Lakes Region boasts a vibrant rental market that can enhance your investment and provide additional financial security.

New Hampshire’s lakeside living offers year-round recreational opportunities that can enrich your lifestyle and create lasting memories for your family. Explore various locations to gain insight into your preferences, and let Cisneros Realty Group assist you in making an informed choice that aligns with your lifestyle and needs.

Are you ready to take the next step in your journey? With our support, you can find a home that not only meets your needs but also nurtures your family's happiness.

Research Local Market Trends in Tuftonboro

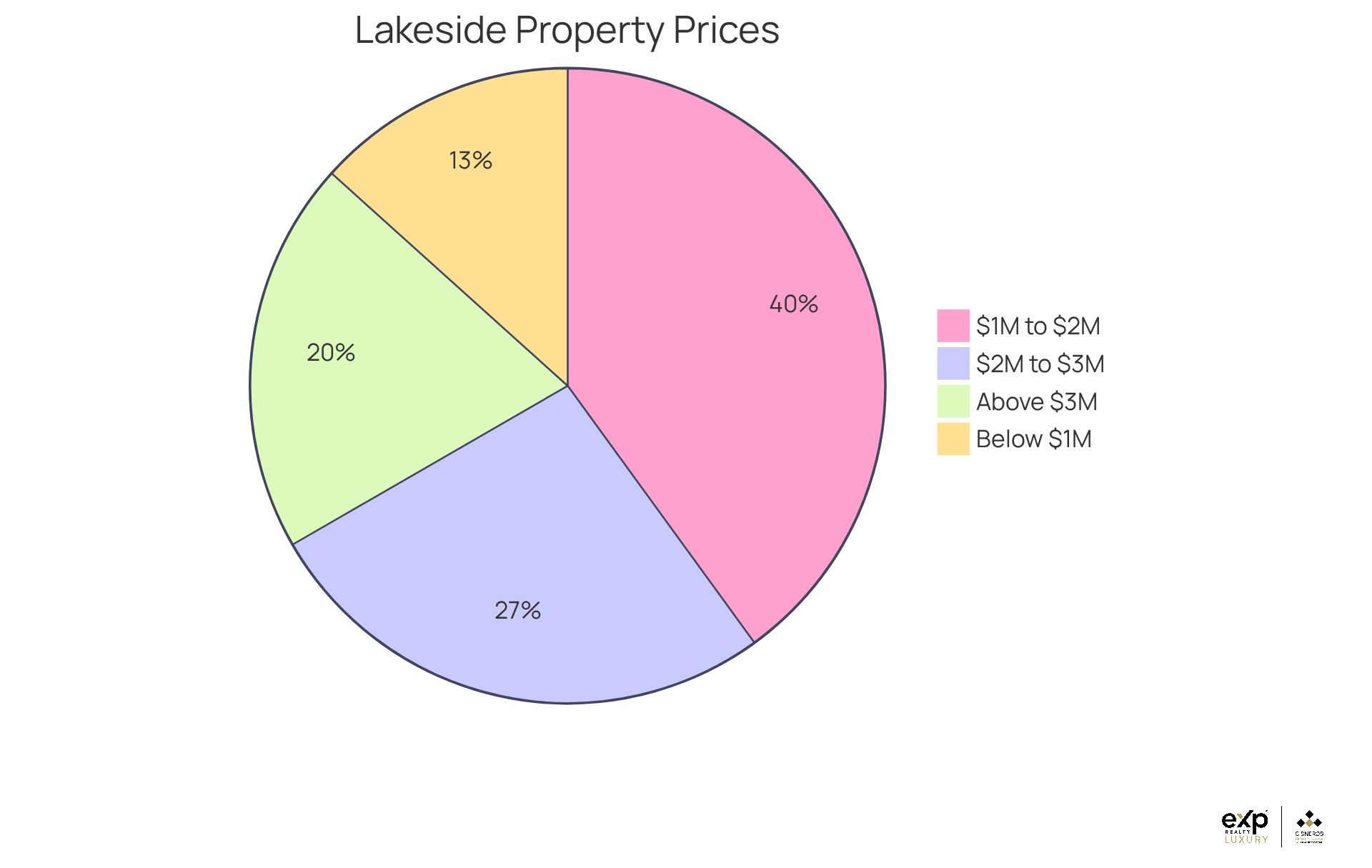

Are you feeling uncertain about the current state of the lakeside property market in Tuftonboro? You're not alone. Many families are navigating these waters, and understanding the latest sales information can help ease those concerns. In 2025, the median sales price for lakeside properties in the Lakes Region reached $2,190,000, with a range from $725,000 to $5,500,000. This variety offers diverse options for buyers, but it also highlights the importance of being informed.

As you explore this market, it’s essential to examine reports that reveal pricing trends and inventory levels. The Lakes Region has seen a decline in lakeside sales compared to previous years, with only 15 transactions recorded in the first five months of 2025. This suggests a competitive environment with limited inventory, which can be daunting for potential buyers. Tracking the average days on the market for waterfront properties, currently at 65 days for 2025, can provide insight into how quickly homes are selling. This information is crucial for adjusting your buying strategy.

Don’t hesitate to reach out to local real estate agents. Their expertise can offer valuable insights into upcoming developments and changes in the industry, assisting you in navigating the unique challenges and opportunities presented by waterfront homes for sale in Tuftonboro NH with a finished basement. Additionally, utilizing online resources to monitor price variations and seasonal trends can empower you to make informed decisions.

Staying updated on local market dynamics will not only help you feel more confident but also enable you to identify the right moment to act. Remember, you’re not just buying a property; you’re investing in a future for your family. Take that next step with assurance.

Inspect the Condition of the Finished Basement

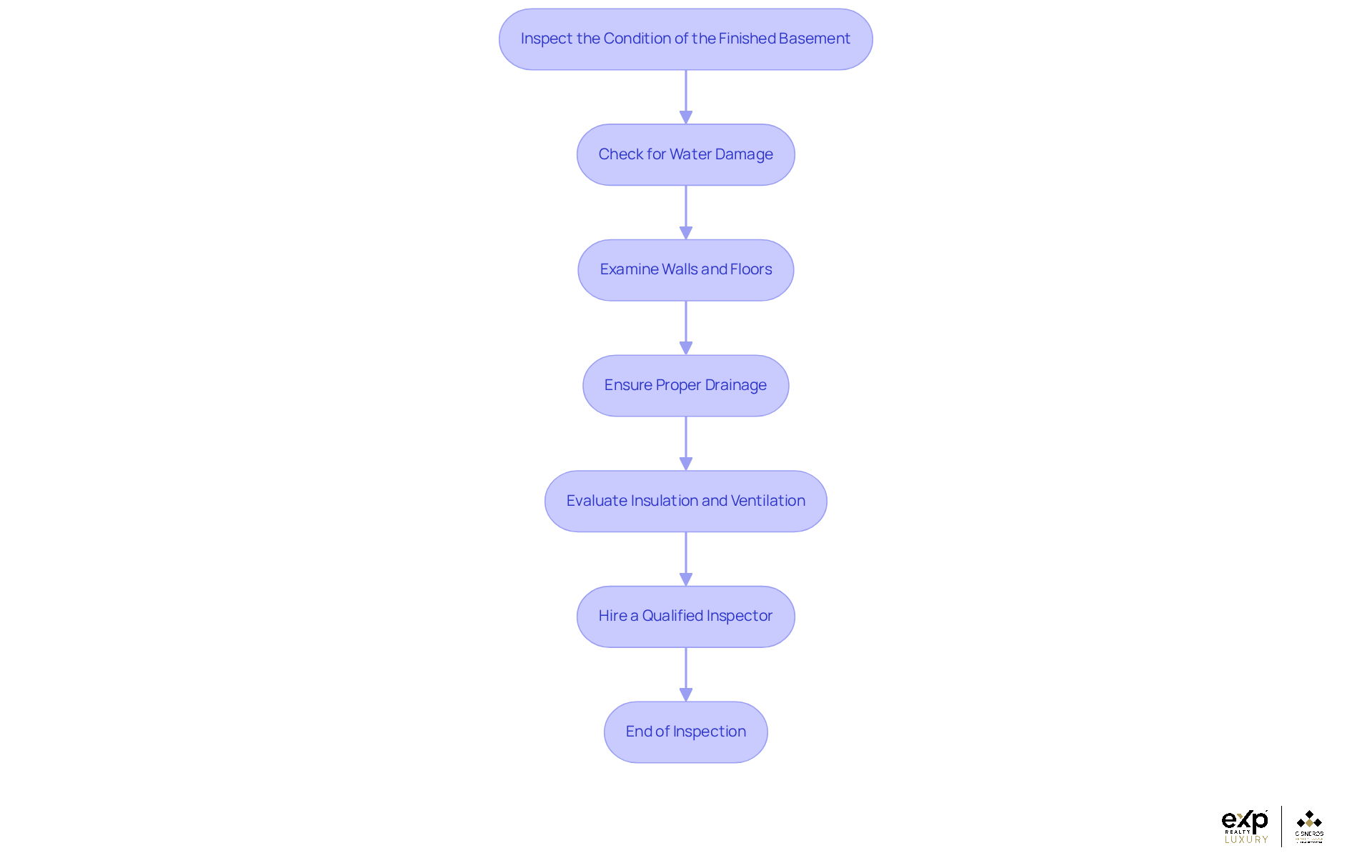

Are you worried about the condition of your future home? It's completely understandable. When looking for signs of water damage, keep an eye out for stains, mold, or musty odors. These can often indicate deeper issues that need your attention. As home inspectors often say, "Visible mold growth is a clear sign of moisture problems that require immediate action."

Take the time to thoroughly examine the walls and floors for any fissures or leaks. These issues can jeopardize the stability of your home. Home inspectors recommend being vigilant for "any signs of water intrusion, especially in basements and crawl spaces."

It's also crucial to ensure that proper drainage systems are in place to reduce the risk of flooding, particularly in areas that experience heavy rainfall. Effective drainage is vital for maintaining the condition of your property and avoiding costly repairs down the line.

Don’t forget to evaluate the insulation and ventilation in the basement. Proper ventilation is essential to prevent moisture buildup, which can lead to mold growth and structural damage. Keeping the space dry and healthy is key to your family's well-being.

Lastly, consider hiring a qualified inspector who specializes in lakeside locations for a thorough assessment. This step ensures that all potential concerns are identified before making a purchase. A knowledgeable inspector can provide invaluable insights, helping you make an informed decision that feels right for you and your family.

Explore Financing Options for Waterfront Homes

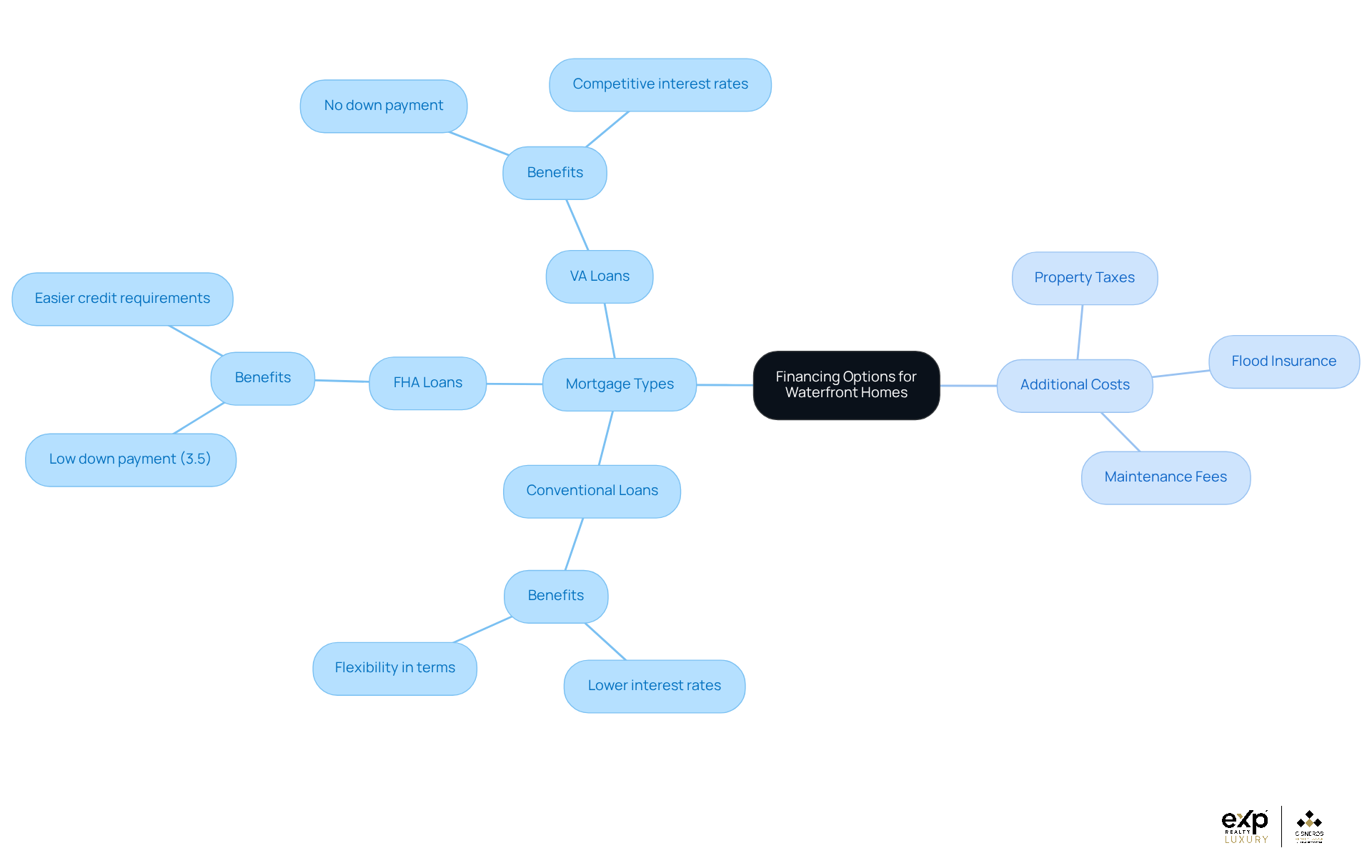

Are you thinking about buying waterfront homes for sale in Tuftonboro NH that feature a finished basement? It’s crucial to understand the financing options available to you. Start by exploring different mortgage types tailored for coastal real estate, like:

- Conventional loans

- FHA loans

- VA loans

Each option comes with its own set of benefits and requirements, so it’s important to find one that fits your financial situation.

Getting pre-approved for a mortgage is a key step in your home-buying journey. Not only does it clarify your budget, but it also strengthens your position when you make an offer on a property. Families looking for funding for waterfront properties often find that pre-approval simplifies their search and enhances their bargaining power.

As of the week ending December 4, 2025, the average interest rate for a 30-year fixed-rate mortgage was 6.63%. This reflects the current market conditions, and it’s wise to compare rates and terms from various lenders to secure the best deal possible. Colleen Boyd emphasizes, "Understanding today’s mortgage landscape is key for prospective buyers to make informed decisions." Working with a mortgage broker who specializes in coastal real estate can provide you with tailored guidance and insight into the unique challenges of financing these homes, such as the need for specialized lenders due to risks from natural disasters and erosion.

Don’t forget to consider the additional costs that come with living by the water, like:

- Flood insurance

- Property taxes

- Maintenance fees

These expenses can significantly affect your overall budget, so it’s essential to include them in your financing plan for long-term affordability. By taking these steps, you can navigate the complexities of financing waterfront homes for sale in Tuftonboro NH with a finished basement and make informed decisions that truly meet your family’s needs.

Conclusion

Purchasing a waterfront home in Tuftonboro, NH, is more than just a transaction; it’s a journey filled with dreams and aspirations. As you embark on this exciting path, remember that careful planning and informed decision-making are your best allies. Establishing a comprehensive budget, pinpointing key features, researching market trends, inspecting property conditions, and exploring financing options are all vital steps that pave the way for a successful investment. Each of these elements is crucial in ensuring that your new home not only meets your family’s needs but also stands as a wise financial choice.

Throughout this guide, we’ve highlighted the importance of thorough preparation. Have you considered the financial implications of property ownership? Or the desirable features that can truly enhance your living experience? Every detail matters. Staying informed about local market dynamics and conducting proper inspections can significantly impact your overall satisfaction and the value of your waterfront property.

The dream of owning a waterfront home in Tuftonboro is within your reach. By taking the time to educate yourself and approaching the process strategically, you can confidently embark on this journey. Following these essential steps ensures that your investment not only provides a beautiful place to live but also creates a lasting legacy for future generations. So, are you ready to take the next step toward making your dream a reality?

Frequently Asked Questions

What should I include in my budget for purchasing a waterfront home in Tuftonboro, NH?

Your budget should include the down payment, closing costs (which typically range from 2% to 5% of the purchase price), property taxes, insurance, and maintenance costs.

What is the average cost of lakefront properties in Tuftonboro in 2025?

The average cost for lakefront properties in Tuftonboro is around $799,000, with an expected increase of 3.7% in property prices.

What are the current property tax rates in Tuftonboro?

Property tax rates in Tuftonboro hover around 1.5%.

How can I estimate my monthly mortgage payments for a waterfront home?

You can use a mortgage calculator to estimate your monthly expenses based on different property prices and down payment amounts.

What mortgage rate is projected for 2025?

Mortgage rates are projected to average 6.3% in 2025.

Why is it important to evaluate the key features of waterfront properties?

Prioritizing features like dock access, water views, and sandy beaches can enhance your enjoyment of the home and its overall value.

What additional amenities should I consider when searching for a lakeside home?

Consider outdoor spaces for entertaining, fire pits, and access to recreational activities such as boating and fishing.

How does the orientation of a home impact my living experience?

The orientation affects sunlight exposure and views, which can significantly enhance your overall satisfaction with the property.

Why is it important to research local regulations regarding waterfront properties?

Understanding regulations about water rights, dock permits, and shoreline modifications is crucial to ensure compliance and avoid legal issues.

Can I expect rental income from waterfront properties in Tuftonboro?

Yes, many buyers consider rental income a significant factor, as the Lakes Region has a vibrant rental market that can enhance your investment.