Introduction

Dreaming of owning a waterfront home in New Hampton, NH? It can feel overwhelming, can’t it? The beauty of the lakes and the tranquility of the landscapes are so inviting, yet the journey to find the perfect property under $500K can seem daunting. What if you had a clear, step-by-step guide to help you navigate this process?

In this article, we’ll explore five essential steps that not only simplify your search for affordable waterfront homes but also empower you with the knowledge to make informed decisions in a competitive market. Let’s embark on this journey together, ensuring you feel supported every step of the way.

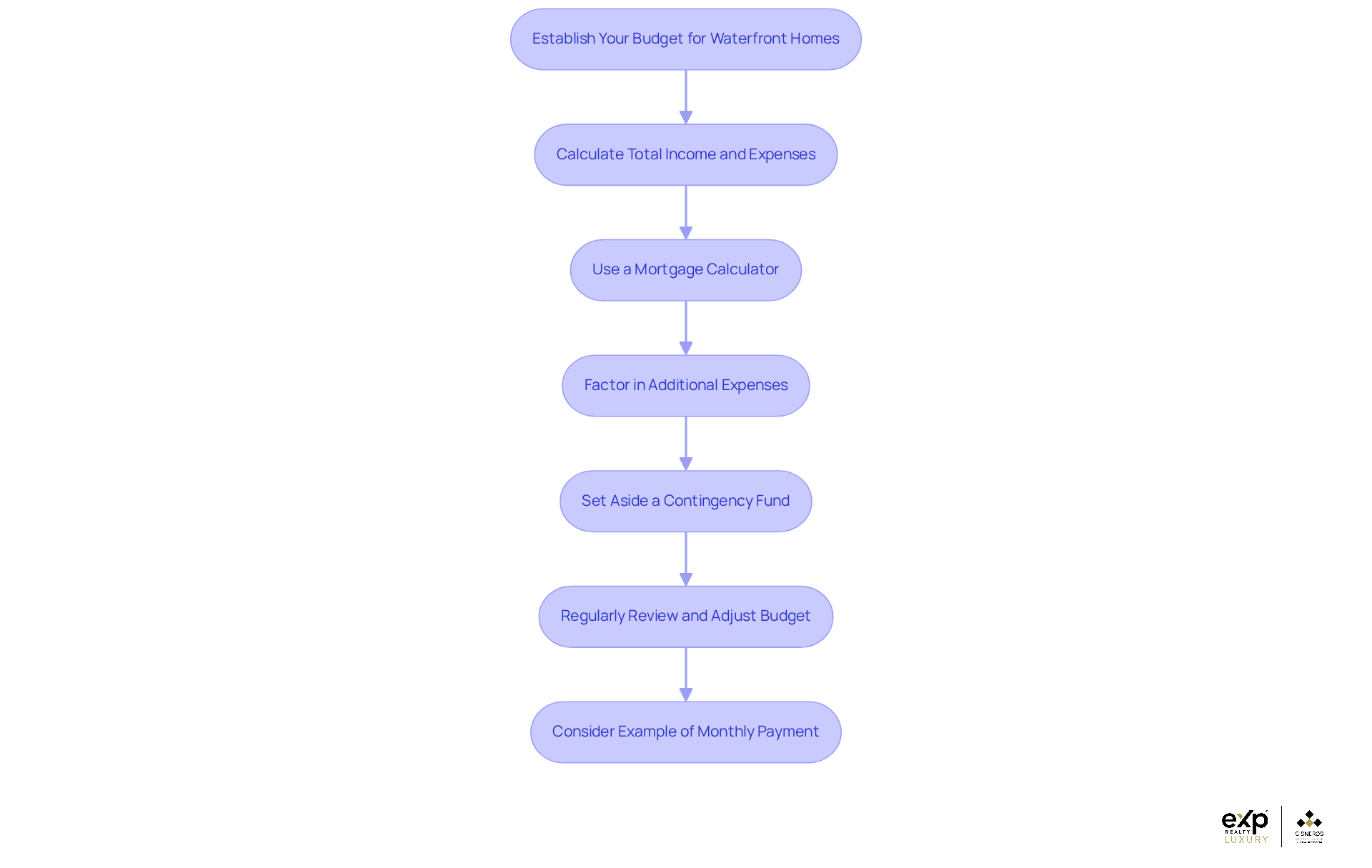

Establish Your Budget for Waterfront Homes

- Have you ever wondered what it truly takes to make your dream of owning waterfront homes for sale in New Hampton NH under 500k a reality? Start by calculating your total income and monthly expenses. This crucial step will give you a clear picture of your financial capacity for homeownership, helping you establish a practical budget for your property search.

- Consider using a mortgage calculator to estimate your monthly payments based on different home prices and interest rates. This handy tool can offer valuable insights into how various scenarios impact your budget, empowering you to make informed decisions.

- Don’t forget to factor in additional expenses tied to lakeside estates. For instance, real estate taxes, which in 2025 average around $17.03 per $1,000 of assessed value-down from $20.95 per $1,000 in 2015. Insurance premiums might be higher due to flood risks, and maintenance costs can add up, especially with the natural elements at play.

- It’s wise to set aside a contingency fund for unexpected costs that come with homeownership, particularly for properties near water that may require extra maintenance, like dock upkeep or storm-proofing measures.

- Regularly reviewing and adjusting your budget is essential. This proactive approach helps you stay on track and ensures your financial planning aligns with your homeownership dreams.

- As Jess Williams, a policy analyst, shares, "Using the June 2025 statewide median single-family house sale price of $565,000, an average 30-year mortgage interest rate of 6.82, and a five percent downpayment, a family buying a property in June 2025 would have a monthly mortgage payment of about $4,308." This example underscores the importance of thorough financial planning when considering waterfront homes for sale in New Hampton NH under 500k.

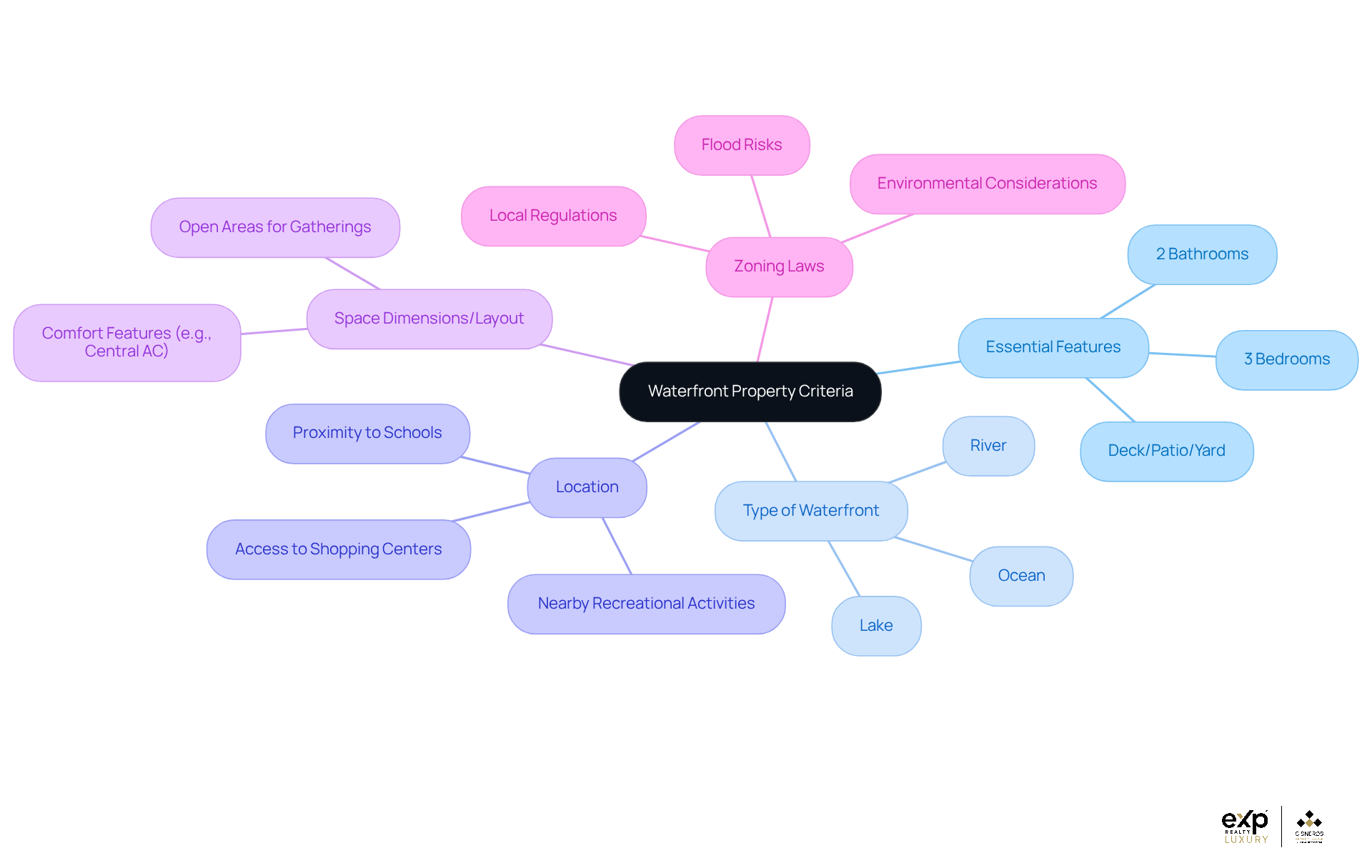

Define Your Waterfront Property Criteria

When considering the ideal family home, have you thought about the waterfront homes for sale in New Hampton NH under 500k and what truly matters? A minimum of three bedrooms and two bathrooms is essential for meeting your family's needs. Outdoor space is equally important - imagine enjoying a deck, patio, or yard for recreational activities. These features not only enhance your family's lifestyle but also significantly boost the appeal and value of waterfront homes for sale in New Hampton NH under 500k.

Next, think about the type of waterfront that resonates with your family. Do you prefer the tranquility of a serene lake, the gentle flow of a river, or the vastness of the ocean? Access options like a private dock or beach area can make a location even more appealing. As Frank Roche highlights, the high demand for waterfront homes for sale in New Hampton NH under 500k is a crucial factor for families looking to settle down.

Location matters too! Evaluate how close your potential home is to schools, shopping centers, and recreational activities. It’s vital for family members to easily access essential services and enjoy local amenities. Many homes in the Lakes Region come equipped with utilities like cable and T1 internet access, which are great for modern family living.

Don’t forget to consider the significance of space dimensions and layout. Open areas that facilitate family gatherings and outdoor fun can create lasting memories. Features like central AC can enhance comfort during those warm summer months, making these homes even more inviting.

It’s also wise to investigate local zoning laws and restrictions that might affect land use. Understanding these regulations is key to making informed decisions about any modifications or developments on your property. Additionally, be aware of potential challenges like flood risks and maintenance concerns, as coastal real estate can face unique environmental factors. Knowing zoning classifications, such as LR-LAK in the Lakes Region, can help you navigate these considerations effectively.

As you embark on this journey, remember that finding the right home is about more than just features - it's about creating a space where your family can thrive. Take the next step with confidence, knowing that your dream waterfront residence is within reach.

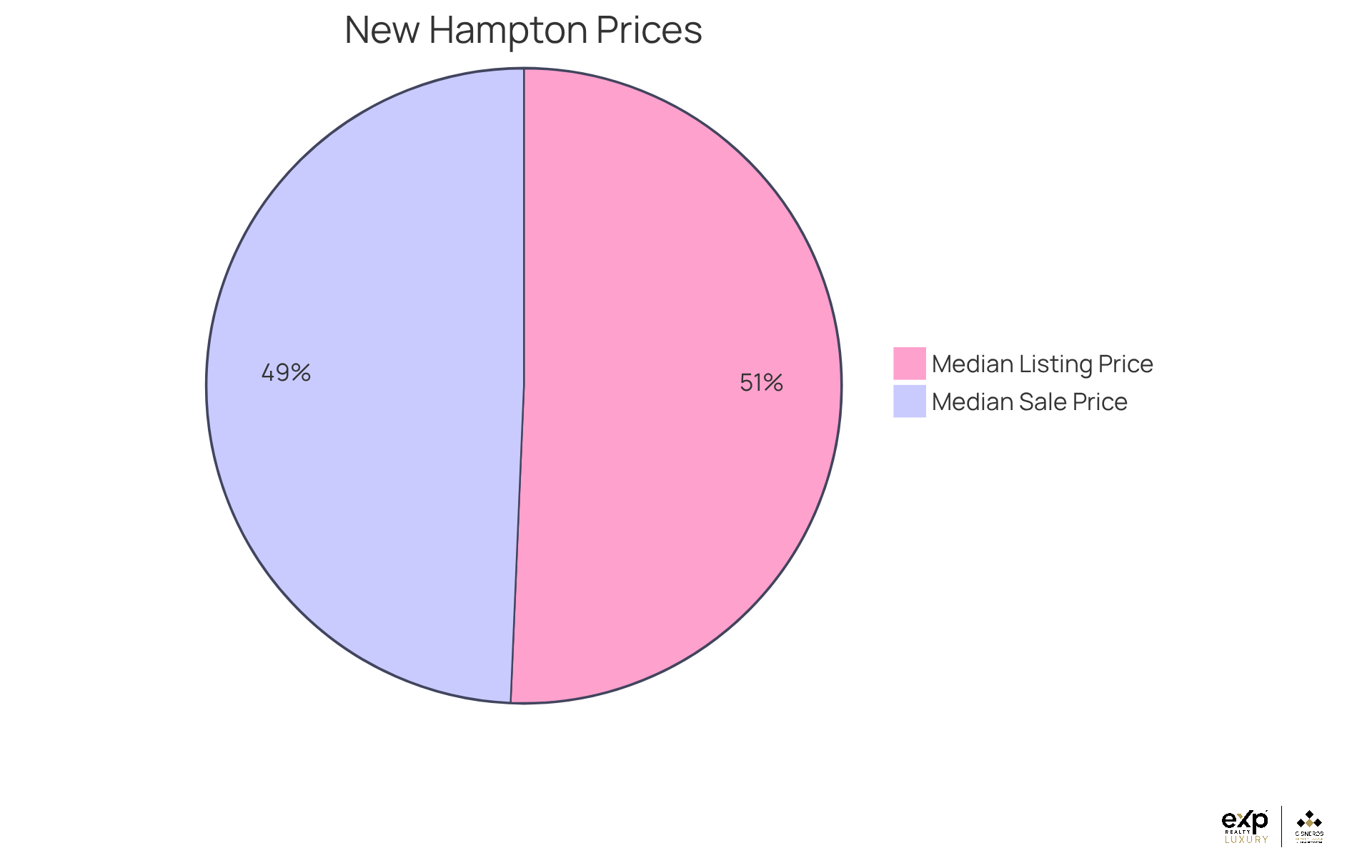

Research New Hampton NH Real Estate Trends

Are you feeling overwhelmed by the competitive waterfront property market in New Hampton? Recent sales data shows a median sale price of $535,000, which reflects an 11% increase from last year. This upward trend indicates a bustling market, especially for waterfront homes for sale in New Hampton NH under 500k. With a median listing price of $549,500, potential buyers have a clearer picture of what to expect.

Navigating this competitive environment can be daunting, but you don’t have to do it alone. Consider utilizing Cisneros Realty Group's complimentary valuation service. This can provide you with a clearer insight into your asset's value and the creative marketing techniques they offer to sellers, helping you feel more confident in your decisions.

Looking at the average days on market for lakeside properties, homes typically sell within 46 days - quicker than the national average of 53 days. This brisk pace highlights the importance of making timely decisions. Seasonal trends also play a significant role in availability and pricing. The peak selling season in the Lakes Region often brings increased competition, so it’s essential to act quickly when suitable listings come up.

To stay informed, make use of local real estate websites and market reports that provide current information on lakeside listings and sales activity. This will help you spot emerging opportunities. Consulting with a local real estate agent from Cisneros Realty Group can offer valuable insights into neighborhoods that are gaining popularity, along with expert advice on navigating the competitive landscape of waterfront homes for sale in New Hampton NH under 500k.

Lastly, it’s important to consider potential hazards associated with real estate in the area, such as moderate wildfire and flooding threats. These are significant factors for buyers to keep in mind. Remember, you’re not just buying a property; you’re investing in a community and a future.

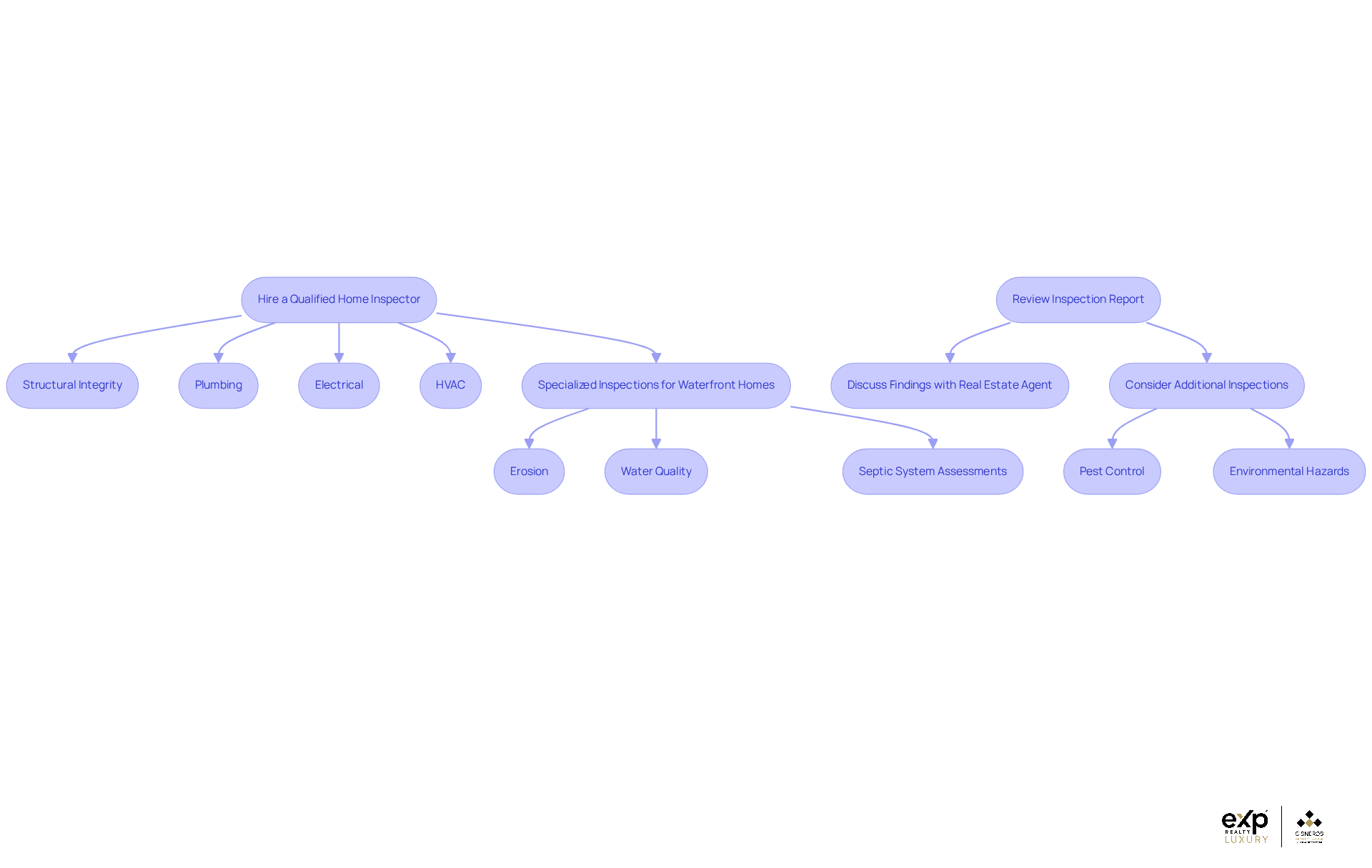

Conduct Property Inspections and Assessments

When you're on the journey to buying a home, it’s crucial to ensure that your future residence is in good shape. Start by hiring a qualified home inspector who can thoroughly assess the condition of the property. They’ll focus on key areas like structural integrity and essential systems, including plumbing, electrical, and HVAC. This step is vital for your peace of mind.

If you’re considering waterfront homes for sale in New Hampton NH under 500k, it’s wise to arrange for specialized inspections. These inspections can uncover potential issues such as erosion, water quality, and septic system assessments, which are important considerations for waterfront homes for sale in New Hampton NH under 500k. This is especially important for homes near protected shoreland zones, as recent regulations have made these checks necessary.

Once you receive the inspection report, take the time to review it carefully. Discuss any findings with your real estate agent to ensure you fully understand any necessary repairs or concerns. This collaborative approach can help clarify your next steps.

You might also want to consider additional inspections for pest control and environmental hazards. These factors can significantly impact both the safety and value of your new home. Remember, being proactive now can save you from bigger issues later.

Finally, use the inspection results to your advantage. Did you know that 46% of buyers leverage these findings to negotiate repairs or price adjustments? Many have successfully negotiated and closed deals for $14,000 below the list price when issues were identified during inspections. This could be a great opportunity for you to secure a better deal on your dream home.

Explore Financing Options for Your Purchase

-

Are you feeling overwhelmed by the different financing options available? It’s completely normal to feel this way. Take a moment to explore various types of loans, such as conventional, FHA, and VA loans, to understand their specific requirements. In New Hampshire, traditional loans typically require a minimum credit score of 620 and a debt-to-income ratio of no more than 45%. If your credit score is at least 580, FHA loans can be a great option, allowing down payments as low as 3.5%. For veterans and active-duty military personnel, VA loans often don’t require a down payment or insurance, making them an appealing choice.

-

Have you considered consulting with multiple lenders? This step is crucial, as loan rates can vary significantly among lenders. As of December 2025, the prevailing loan interest rates in New Hampshire are 6.44% for a 30-year fixed rate and 6.13% for a 15-year fixed rate. With rates slightly decreasing due to recession concerns, it’s even more important to reach out to at least three different banks or lending companies to find the best financing options available.

-

Strengthening your buying position can be as simple as obtaining mortgage pre-approval. This not only gives you a clearer picture of your budget but also signals to sellers that you’re a serious buyer. In competitive markets, particularly where waterfront homes for sale in New Hampton NH under 500k are highly sought after, this can make a significant difference.

-

If you’re eyeing waterfront homes for sale in New Hampton NH under 500k, consider exploring specialized loans that may offer unique terms. Properties near water can come with their own set of complexities, such as higher insurance costs and maintenance considerations. Some lenders may provide customized financing solutions tailored to these specific needs.

-

Don’t forget to factor in potential extra expenses, like increased insurance premiums for waterfront homes for sale in New Hampton NH under 500k. Homeowners insurance for residences in flood zones can be notably higher, so budgeting for these costs is essential when assessing your overall affordability. Additionally, consider the potential for higher rental income from waterfront homes for sale in New Hampton NH under 500k, which can be an attractive point for investors looking to cover ownership costs. Understanding these financial implications will help ensure a smoother purchasing process and long-term satisfaction with your investment.

Conclusion

Finding the perfect waterfront home for sale in New Hampton, NH, under $500K can feel like a dream come true, especially when you approach it with the right mindset and knowledge. Imagine establishing a budget that feels comfortable, defining your ideal property features, and diving into local market trends. With thorough inspections and a variety of financing options at your fingertips, you can navigate the real estate landscape with confidence.

This guide highlights key insights that underscore the importance of financial planning and understanding property features. Staying informed about market dynamics is crucial. We encourage buyers to take a proactive stance - tools like mortgage calculators and local real estate services can empower you to make informed decisions. Plus, recognizing the significance of property inspections not only prevents future complications but also enhances your negotiation power.

Ultimately, the journey to owning a waterfront home is about more than just the property; it’s about creating a vibrant lifestyle and cherishing lasting memories. As you embark on this exciting opportunity, remember to invest in your future. Stay diligent in your research and preparation. With the right resources and a positive mindset, the dream of owning an affordable waterfront home in New Hampton can truly become a reality.

Frequently Asked Questions

How should I start budgeting for waterfront homes in New Hampton, NH under $500k?

Begin by calculating your total income and monthly expenses to understand your financial capacity for homeownership. This will help you establish a practical budget for your property search.

What tools can help me estimate my monthly mortgage payments?

You can use a mortgage calculator to estimate your monthly payments based on different home prices and interest rates. This tool can provide insights into how various scenarios affect your budget.

What additional expenses should I consider when purchasing a waterfront home?

Additional expenses include real estate taxes, insurance premiums (which may be higher due to flood risks), and maintenance costs, particularly for properties near water. It's also advisable to set aside a contingency fund for unexpected costs.

Why is it important to regularly review and adjust my budget?

Regularly reviewing and adjusting your budget helps you stay on track and ensures your financial planning aligns with your homeownership goals.

What are some key criteria to consider when defining my waterfront property needs?

Key criteria include having a minimum of three bedrooms and two bathrooms, outdoor space for recreational activities, and the type of waterfront (lake, river, or ocean) that appeals to your family.

How does location impact my choice of waterfront home?

Location is crucial; consider proximity to schools, shopping centers, and recreational activities to ensure easy access to essential services and local amenities.

What features should I look for in the layout of a waterfront home?

Look for open areas that facilitate family gatherings and outdoor fun, as well as features like central AC for comfort during warm months.

Why is it important to understand local zoning laws and restrictions?

Understanding local zoning laws and restrictions is key to making informed decisions about land use, modifications, or developments on your property, especially in areas with unique environmental factors.

What challenges might I face with coastal real estate?

Potential challenges include flood risks and maintenance concerns due to environmental factors associated with coastal properties. Being aware of zoning classifications can help navigate these considerations.