Introduction

Embarking on the journey to purchase a waterfront home in Wolfeboro, NH, can stir a mix of excitement and apprehension. The dream of lakeside living is enticing, yet it comes with a host of financial considerations, regulatory complexities, and property-specific inspections that you’ll need to navigate. This checklist is designed to be your comprehensive guide, helping you explore essential budgeting strategies, financing options, and local regulations that can greatly influence your buying experience.

But amidst the thrill of discovering that perfect lakeside retreat, have you considered the hidden challenges that might await? It’s crucial to be prepared for the intricacies of waterfront property ownership. By understanding these factors, you can approach your home-buying journey with confidence and clarity.

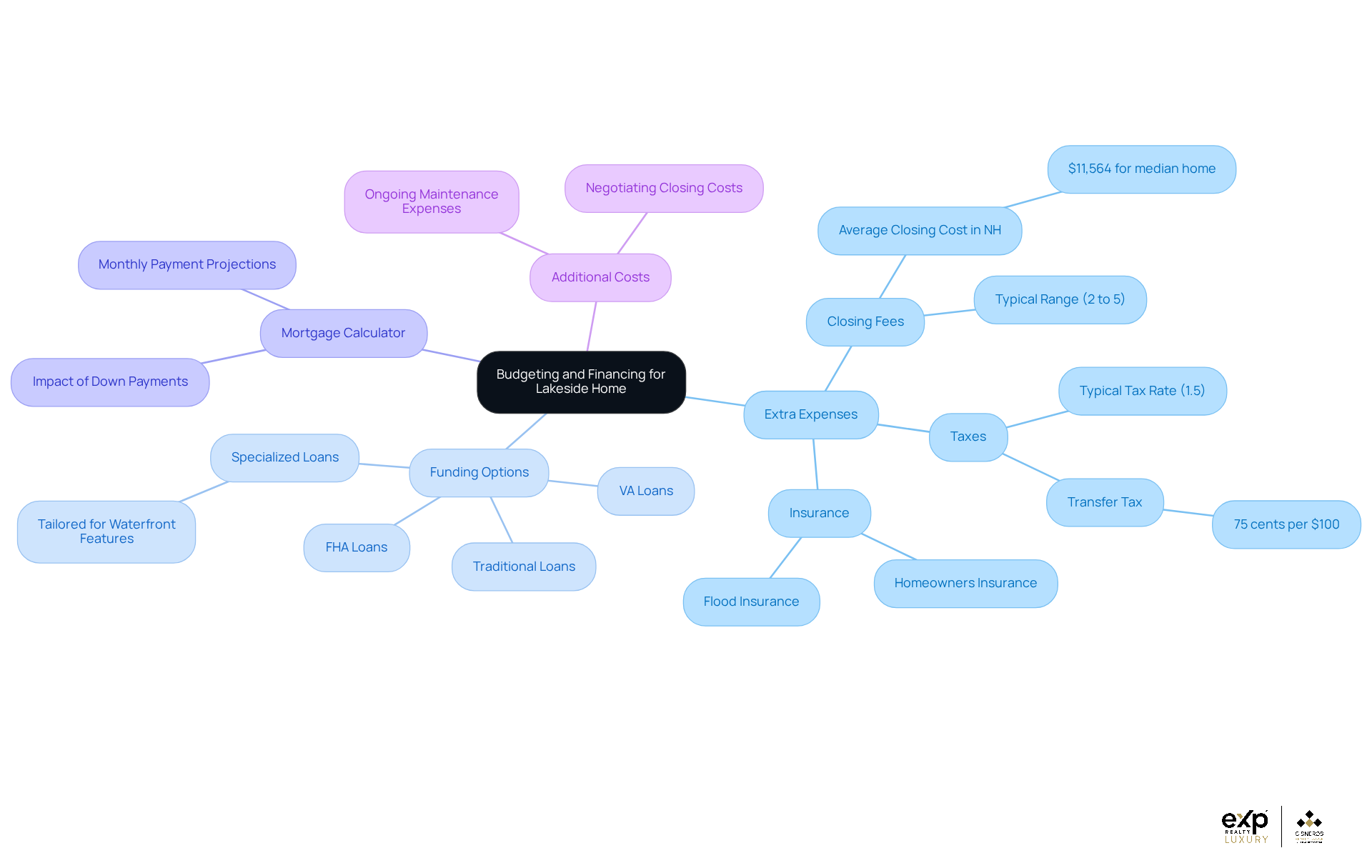

Establish Your Budget and Financing Options

When considering your overall budget for a lakeside home in Wolfeboro, it’s important to think beyond just the purchase price. Have you factored in extra expenses like closing fees, taxes, and insurance? For instance, the typical tax rate here is around 1.5% of the assessed value, which can significantly impact your budget. Additionally, in New Hampshire, closing costs usually range from 2% to 5% of the purchase price. These details are crucial to keep in mind as you plan your finances.

Next, let’s explore the various funding options available for coastal real estate. You might want to look into:

- Traditional loans

- FHA loans

- VA loans

- Specialized loans tailored for unique waterfront features

Each of these options comes with its own eligibility criteria and benefits, which can influence your purchasing power. It’s worth taking the time to understand what fits your situation best.

Have you tried using a mortgage calculator? This handy tool can help you project your monthly payments based on different down payment scenarios. Visualizing how varying down payments affect your monthly financial commitments can be enlightening, especially considering current mortgage rates, which hover around 5.99% for 30-year fixed loans as of December 2025.

Connecting with a financial advisor or mortgage broker can also be a game-changer. They can help you assess your credit score and explain how it impacts your loan options. Understanding your credit profile is vital, as it can determine the interest rates and terms available to you.

Lastly, don’t forget about the additional costs associated with waterfront homes for sale in Wolfeboro NH with 100ft frontage. Flood insurance and ongoing maintenance expenses can add to your overall financial commitment, so it’s essential to budget for these as well. In competitive markets, consider negotiating closing costs or asking for seller contributions to lighten your financial load. Remember, you’re not alone in this journey; taking these steps can help you feel more secure and prepared as you move forward.

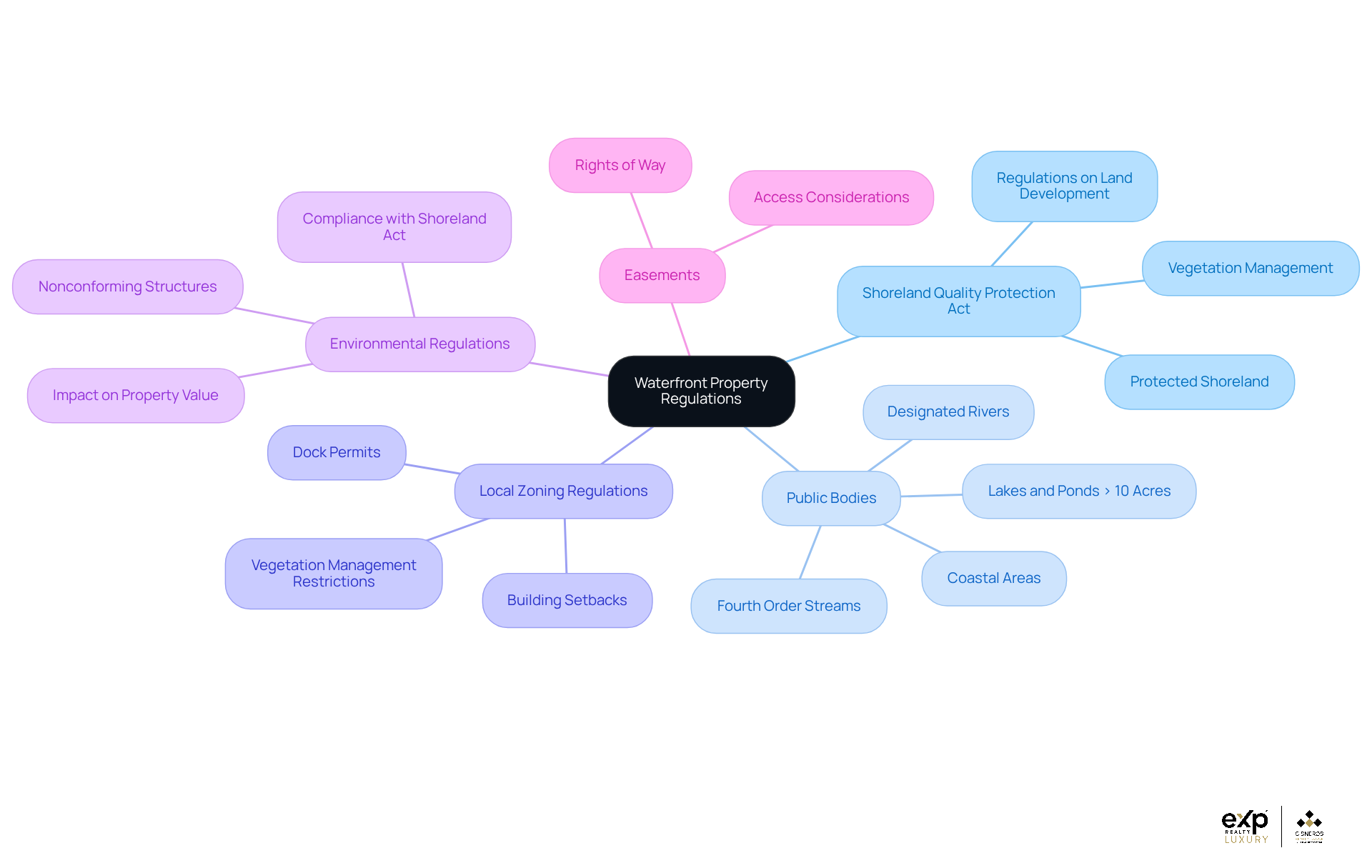

Understand Waterfront Property Regulations

Have you ever felt overwhelmed by the complexities of buying property near the water? Understanding the Shoreland Quality Protection Act (RSA 483-B) is a crucial first step. This act sets important regulations for property development within the protected shoreland, which is defined as the area within 250 feet of the reference line of public bodies. Its primary goal is to safeguard water quality by regulating land development, vegetation management, and other activities in these designated areas. Notably, it also protects fourth order and higher streams, ensuring that significant waterways receive the oversight they deserve.

Public bodies include lakes, ponds, and impoundments larger than 10 acres, as well as year-round flowing streams of fourth order or higher, designated rivers, and coastal areas. Familiarizing yourself with these definitions is essential, especially if you're considering a purchase of waterfront homes for sale in Wolfeboro NH with 100ft frontage in these beautiful locations.

As you explore waterfront homes for sale in Wolfeboro NH with 100ft frontage, don’t forget to check local zoning regulations. These may include:

- Building setbacks

- Dock permits

- Restrictions on vegetation management

Pay special attention to the shore buffer, the area within 50 feet of the reference line of public waters, as it plays a vital role in maintaining the natural beauty of the area.

It’s wise to consult with local authorities or a real estate attorney to clarify any specific regulations that may pertain to your desired asset. This step is crucial for navigating the complexities of coastal real estate ownership and ensuring you fully understand your rights and responsibilities.

Additionally, reviewing any existing easements or rights of way that may impact access or usage of the land is important. These legal considerations can significantly affect your enjoyment and use of the area by the water.

Lastly, understanding the implications of environmental regulations on real estate maintenance and development is key. Compliance with these regulations not only protects the natural beauty of the area but also enhances the long-term value of your investment. Be mindful of nonconforming structures, which may not meet the provisions of the Shoreland Water Quality Protection Act and could present challenges down the line.

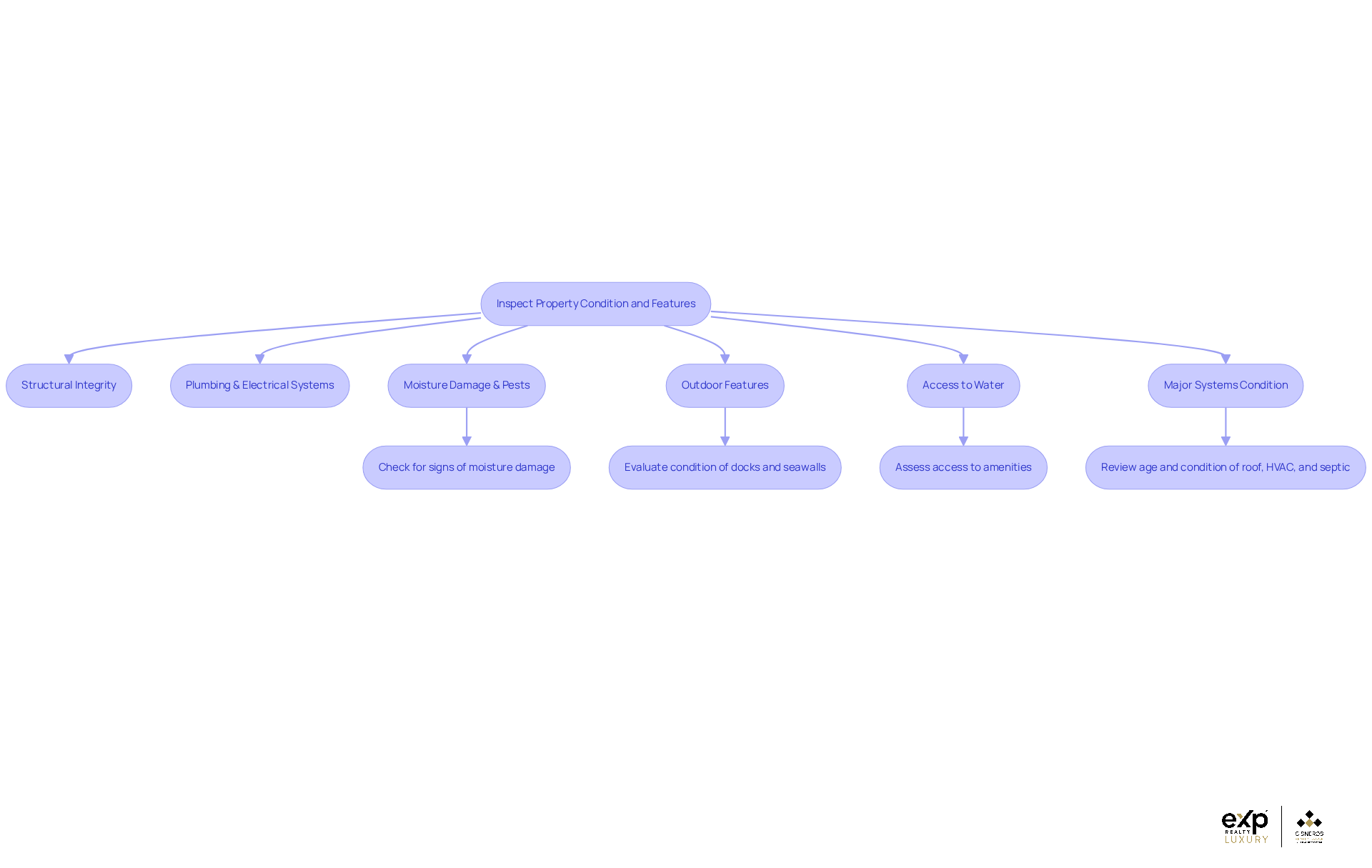

Inspect Property Condition and Features

When considering a home near the coast, it's essential to have a qualified home inspector who understands the unique challenges of coastal real estate. Have you thought about how structural integrity, plumbing, and electrical systems can impact your peace of mind? A skilled inspector can help you navigate these concerns, ensuring your new home is safe and sound.

As you explore potential homes, keep an eye out for signs of moisture damage, mold, or pest infestations. These issues can be more common in coastal areas, and addressing them early can save you from future headaches. Imagine settling into your dream home, free from worries about hidden problems.

Don’t forget to evaluate the condition of outdoor features like docks, seawalls, and landscaping. These elements not only enhance your property’s appeal but also contribute to your enjoyment of coastal living. How do you envision spending your time by the water?

Consider the site's access to the water and any amenities it offers, such as a private beach or boat launch. These features can significantly enhance your lifestyle, making every day feel like a vacation.

Lastly, reviewing the age and condition of major systems like the roof, HVAC, and septic is crucial. Understanding these aspects can help you anticipate future maintenance needs, allowing you to plan ahead and enjoy your new home without unexpected surprises.

Taking these steps will empower you to make informed decisions, ensuring your coastal home is a place of comfort and joy.

Research Local Market and Community Amenities

Have you ever dreamed of living by the water? In Wolfeboro, waterfront homes for sale in Wolfeboro NH with 100ft frontage are not just a dream; they’re a vibrant reality. Recent sales data reveals that this charming town is experiencing a dynamic market, with average values reflecting its undeniable appeal. The median list price for lakeside homes hovers around $899,000, and properties often sell close to their asking price when priced competitively. This trend highlights the strong demand for waterfront homes for sale in Wolfeboro NH with 100ft frontage, set in such a picturesque location.

What makes Wolfeboro truly special are its community amenities, which significantly enhance the living experience. The town is home to several parks, recreational facilities, and lively local events that nurture a strong sense of community. Families will appreciate the access to quality schools and healthcare facilities - key factors that influence property values. The local school district is renowned for its commitment to educational excellence, making it an attractive choice for families seeking a nurturing environment for their children.

Moreover, the proximity to shopping, dining, and entertainment options enriches the lifestyle for residents. Picture a delightful downtown area filled with unique shops and cozy eateries, ensuring that everything you need is just a short stroll away. This accessibility to vital services and recreational activities truly enhances the quality of life.

Engaging with local real estate agents can be a game-changer, offering valuable insights into upcoming developments and market changes. This knowledge empowers potential buyers to make informed decisions. As the Lakes Region continues to evolve, staying updated on community enhancements and market trends is essential for anyone considering waterfront homes for sale in Wolfeboro NH with 100ft frontage. So, why not take that next step? Your dream home by the lake awaits!

Conclusion

As you consider the journey of purchasing a waterfront home in Wolfeboro, NH, it’s essential to recognize the many layers involved:

- Budgeting

- Regulations

- Inspections

- The local market

This checklist is here to guide you through the intricacies of securing your dream lakeside property, ensuring you feel prepared and confident at every step.

Have you thought about what a realistic budget looks like? It’s important to factor in additional costs like taxes and insurance. Understanding the Shoreland Quality Protection Act is also crucial for complying with local regulations, and thorough property inspections can help uncover any potential issues. Plus, the vibrant community amenities and the dynamic real estate market in Wolfeboro make waterfront living even more appealing. Staying informed about local trends can truly enhance your experience.

Ultimately, investing in a waterfront home in Wolfeboro is more than just acquiring property; it’s about embracing a lifestyle enriched by nature and community. By using this checklist, you can approach the market with confidence, ready to make informed decisions that align with your dreams and financial goals. So, take that next step toward making your lakeside living aspirations a reality, and immerse yourself in the beauty and tranquility that waterfront life has to offer.

Frequently Asked Questions

What should I consider when establishing my budget for a lakeside home in Wolfeboro?

When establishing your budget, consider not just the purchase price but also extra expenses like closing fees, taxes, and insurance. The typical tax rate is around 1.5% of the assessed value, and closing costs usually range from 2% to 5% of the purchase price.

What financing options are available for purchasing coastal real estate?

Available financing options include traditional loans, FHA loans, VA loans, and specialized loans tailored for unique waterfront features. Each option has its own eligibility criteria and benefits.

How can a mortgage calculator assist me in my home buying process?

A mortgage calculator can help you project your monthly payments based on different down payment scenarios, allowing you to visualize how varying down payments affect your financial commitments.

What are the current mortgage rates for 30-year fixed loans?

As of December 2025, the current mortgage rates for 30-year fixed loans hover around 5.99%.

Why is it important to connect with a financial advisor or mortgage broker?

Connecting with a financial advisor or mortgage broker can help you assess your credit score and understand how it impacts your loan options, which is vital for determining the interest rates and terms available to you.

What additional costs should I budget for when buying a waterfront home in Wolfeboro?

Additional costs to budget for include flood insurance and ongoing maintenance expenses, which can significantly add to your overall financial commitment.

Are there ways to negotiate costs when purchasing a home in a competitive market?

Yes, in competitive markets, you can consider negotiating closing costs or asking for seller contributions to help lighten your financial load.